Review of GuruPay — Safe Payments

Looking for the top most secure online payment company? It is worth paying attention to GuruPay electronic money institution!

Finscanner will review this newly-established EMI that provides e-money and payment services for both private and corporate clients. Our GuruPay analysis covers everything you need to know about their open solutions and services, containing the latest information.

Learn more about EMIs in our article «Banking with Electronic Money Institutions».

GuruPay is an authorized electronic money institution based in Vilnius, Lithuania in 2019. It offers financial services activities i.e. issuance of e-money, payment execution (domestic and cross-border), the opening of IBAN accounts, prepaid cards, etc.

All client funds are stored in the Central Bank of Lithuania and the institution itself is regulating its activities in accordance with the laws of the European Union and the legal acts of the Central Bank of Lithuania.

During the latest years, the number of customers of GuruPay has increased and the number of payments made jumped several times. According to Aleksandras Karpickis, the company's co-founder and CEO, this was due to additional strategic direction focusing on small and medium-sized commercial and fintech business companies during the pandemic and changed business conditions after Brexit.

The company is well-positioned for a corporate high-demanding clientele, especially in e-gaming, fully licensed gambling, affiliate businesses, and e-commerce industries. According to Finscanner, GuruPay is a Top-1 e-Money Institution for high-risk businesses in 2022. Learn more here.

✅ Pros

- High degree of security and transparency

- C2B accounts

- Offshore companies accepted

- Crypto-friendly accounts

- API integration

- Fast onboarding procedure

- Debit cards, personal accounts

❌ Cons

- No dedicated SWIFT IBAN

- EUR account only

NOTE: The above-mentioned pros and cons are drawn up by the Finscanner team’s point of view, while other GuruPay reviews may say otherwise.

Profile

GuruPay is authorized and regulated by the Bank of Lithuania, license No. 59.

- Currency: EUR

- Business focus: unique IBAN accounts, customized payment solutions, SEPA payments.

- Products: personal IBAN accounts, business IBAN accounts, prepaid cards, accumulative bank accounts.

- Customer groups: EEA residents, non-EEA residents, premium customers.

- Authorized activities: issuance of electronic money, execution of payment transactions on a payment account (not covered by a credit line), issuing payment instruments, or acquiring payment transactions.

- Operations with cryptocurrencies: No

Business IBAN Accounts, Pricing

Lithuania based

(E-Commerce, Retail, Accountancy):

- Initial Fee: 25 EUR

- Monthly Fee: 25 EUR

- Closing Fee: 25 EUR

- SEPA Outgoing: 1.00 - 5.00 EUR

- SEPA Incoming: Free

- SWIFT Outgoing: 0.1% (Min 45 EUR)

- SWIFT Incoming: 0.1% (Min 10 EUR)

EEA/Non-EEA based

(E-Commerce, Retail, Logistics, Provision of legal services, Legal practice, Marketing, Accountancy, Independent legal professionals, Tax advisors, IT development, Intermediary services):

- Initial Fee: 250 EUR/ 750 EUR

- Monthly Fee: 50 EUR/ 200 EUR

- Closing Fee: 150 EUR

- SEPA Outgoing: 1.00 - 10 EUR/ 0.1% (Min 5 - 50 EUR)

- SEPA Incoming: Free/ 0.1%

- SWIFT Outgoing: 0.2% (Min 70 EUR)/ 0.4% (Min 120 EUR)

- SWIFT Incoming: 0.1% (Min 10 EUR)/ 0.1% (Min 10 EUR)

EEA/Non-EEA based high-risk business

(Media, Affiliates, Online Advertising, Forex, Activities involving gambling, gaming and/or any other activity with an entry fee and a prize, including, but not limited to casino games, lottery, games of skill and sweepstakes (Only regulated), PSP, Financial services, Money transfer services, Insurance, provision Notary practice, Real Estate, Well known dating sites):

- Initial Fee: 1250 EUR/ 2500 EUR

- Monthly Fee: 250 EUR/ 300 EUR

- Closing Fee: 150 EUR

- SEPA Outgoing: 0.25%/ 0.5%

- SEPA Incoming: 0.1%/ 0.5%

- SWIFT Outgoing: 0.5% (Min 120 EUR)/ 0.5% (Min 120 EUR)

- SWIFT Incoming: 0.1% (Min 10 EUR)/ 0.5% (Min 20 EUR)

Personal IBAN Accounts, Pricing

EEA/Non-EEA based:

- Initial Fee: Free/ 100 EUR

- Monthly Fee: 5 EUR/ 20 EUR

- Closing Fee: Free/ 150 EUR

- SEPA Outgoing: 1.00 EUR/ 5.00 EUR

- SEPA Incoming: Free/ 5.00 EUR

- SWIFT Outgoing: 0.1% (Min 45 EUR)/ 0.2% (Min 70 EUR)

- SWIFT Incoming: 0.1% (Min 10 EUR)

Special

(applicable if a client requires higher than standard permanent limits and/or operates under an individual business/freelance certificate):

- Initial Fee: 250 EUR

- Monthly Fee: 50 EUR

- Closing Fee: 250 EUR

- SEPA Outgoing: 10 EUR

- SEPA Incoming: 10 EUR

- SWIFT Outgoing: 0.4% (Min 120 EUR)

- SWIFT Incoming: 0.1% (Min 10 EUR)

Debit Cards, Pricing

Both physical and virtual Mastercard debit cards are compatible with ATMs all over the world. Businesses can apply for an unlimited number of corporate cards with separate IBAN and multicurrency payments.

- Card issuing, including card delivery: 49 EUR

- Card load (internal transfer from IBAN account): Free

- FX fee (applied when transactions are not in EUR): 2%

- Transaction fee: 0.5% (min 1 EUR)

- ATM cash withdrawal fee: 2.5% (min 5 EUR)

Accumulative Bank Account

GuruPay offers an accumulative bank account for both legal and individual incorporators to deploy an authorized capital. The account is required to establish a private limited liability company in Lithuania. No payments can be made from this account. The authorized capital can be transferred only from within the SEPA area in EUR currency.

Crypto-Friendly Business Accounts

GuruPay facilitates crypto-related businesses to open accounts for transfers to/from crypto platforms. The crypto-client category is subject to the business pricing plan for high-risk business (see above).

Summary

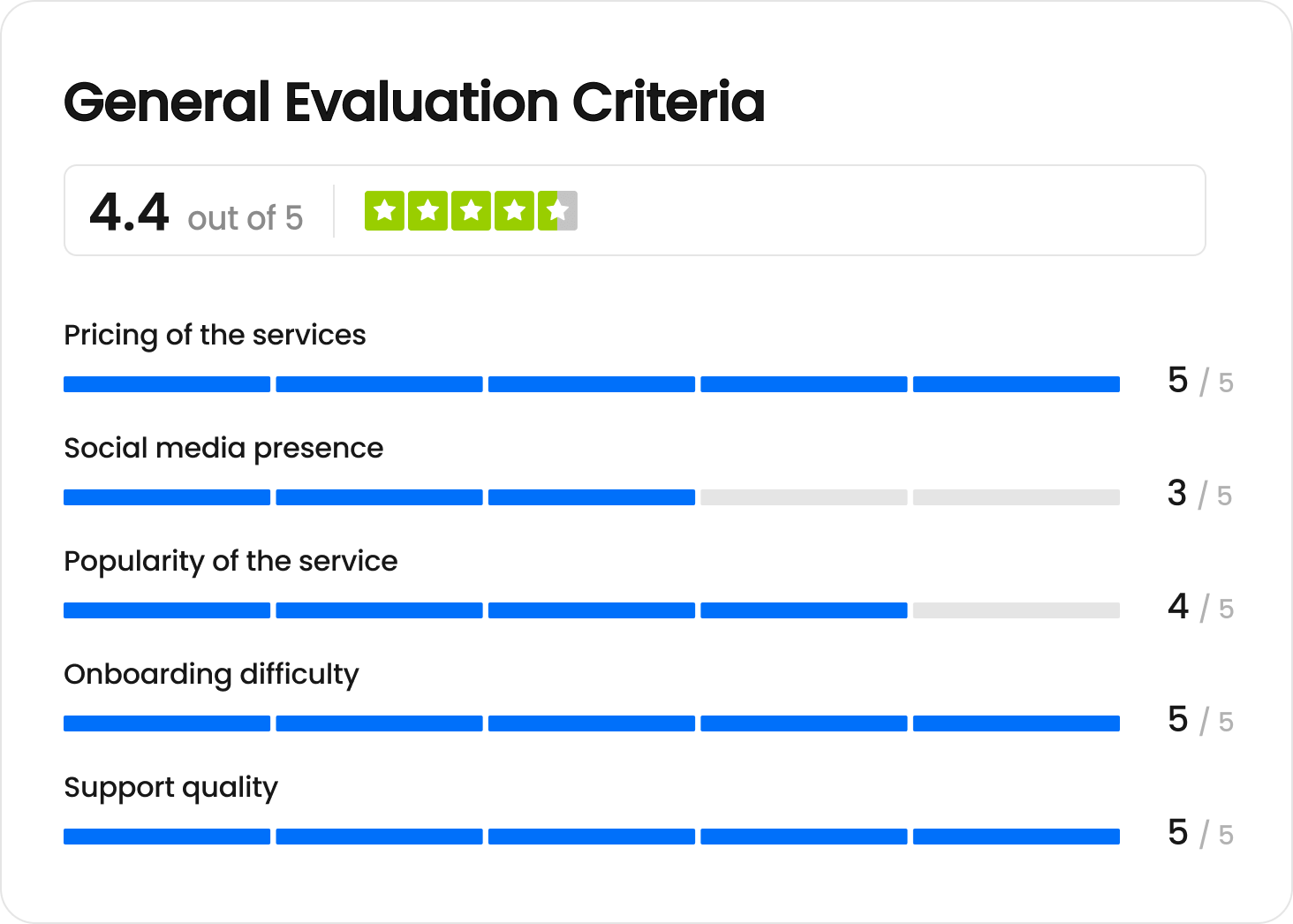

To assign a rating score, Finscanner assesses such key criteria as the pricing of the services, onboarding difficulty, support quality (customer service), and service popularity. In summary, GuruPay was assigned the overall rating of 4.4 (Excellent) which is explained in detail below.

Expert Review of GuruPay

“Despite the short period since its appearance on the market, GuruPay has managed to prove itself perfectly. I would say that the company occupied its niche in a timely manner, which allowed it to find a high demand among SMEs.

After all, we are talking about everyday banking products guaranteed by the reliability and security of the Bank of Lithuania. Combined with customizable payment solutions tailored to the specific needs of the business and a fast onboarding procedure, we got a forward-looking e-money institution. I assume that having gained experience, the company will expand its segment, which will help it to further grow its client base and put more competitive pressure on large market players in the foreseeable future.“

Are you ready to start using GuruPay?

All you need to do is to go to the Finscanner marketplace, search for the GuruPay profile, and hit the "Apply" button. Next, you need to set up your Business or Individual account and pass verification. The application review procedure usually takes up to 2 business days when all the required documentation is provided.

If you still have any questions left, feel free to contact us directly today!

Read also

Review of Nexpay — Next generation financial infrastructure for the digital business world

Finscanner will review this fintech startup that focuses on providing...

Review of IBS — Financial link between Europe and China

Looking for an innovative channel for funds transfer? It is worth paying attention to IBS electronic money institution!