Review of IBS — Financial link between Europe and China

Looking for an innovative channel for funds transfer? It is worth paying attention to IBS electronic money institution!

Finscanner will review this global fintech company that focuses on constructing a global cross-border payment clearing and settlement network with regional clearing circles. Our IBS analysis covers everything you need to know about their open solutions and services, containing the latest information.

Learn more about EMIs in our article «Banking with Electronic Money Institutions».

IBS is an authorized electronic money institution based in Vilnius, Lithuania in 2016. It offers virtual personal and business IBAN accounts, merchant accounts with IBAN, SEPA transfers, SWIFT transfers, international payments, currency exchange, customer payments processing, Alipay, WeChat Pay and UnionPay international acquiring solutions to individuals and businesses.

It is set to greatly increase cross-border trade value and provide a fast, safe, and low-cost direct payment channel between Europe and China.

In light of recent events, the firm has supported the initiative to send crypto donations to Ukraine by entering an arrangement with the National Bank of Ukraine (NBU) and crypto payment processor Coingate. It is responsible for approving and sending payments directly to the special donation accounts that have been set up by the NBU.

IBS is placed in the Top-10 best e-Money Institutions for high-risk businesses in 2022.

✅ Pros

- Low transaction fees

- Open for cooperation with MSBs and PSPs

- Personal accounts

❌ Cons

- No C2B accounts

- No debit cards

- No offshore jurisdictions

- Long onboarding procedure

NOTE: The above-mentioned pros and cons are drawn up by the Finscanner team’s point of view, while other IBS reviews may say otherwise.

Profile

International Business Settlement (IBS) is an e-money institution that operates under IBS Lithuania UAB (304310405), authorized by the Bank of Lithuania (authorization number LB000404). It is part of International Business Reconciliation Holdings Limited, which is a company listed on the Hong Kong Stock Exchange (Hong Kong Stock Exchange Stock Code: (00147.HK)).

Currency: EUR, USD, GBP, CNY, HKD

Business focus: digital banking services between Europe and China.

Products: virtual personal and business IBAN accounts, merchant accounts with IBAN.

Customer groups: EU residents, non-EU residents.

Authorized activities: issuance of electronic money, placing cash to a payment account, withdrawing cash from a payment account, execution of payment transactions on a payment account (not covered by a credit line), issuing payment instruments, or acquiring payment transactions, money remittance.

Crypto-Related Activities: Yes

Business Accounts, Pricing

EEA Residents:

Initial Fee: 50 EUR

Monthly Fee: 10 EUR

SEPA Outgoing: 2 EUR

SEPA Incoming: 1 EUR

SWIFT Outgoing: 30 EUR

SWIFT Incoming: 10 EUR

Non-EEA Residents:

Initial Fee: 200 EUR

Monthly Fee: 50 EUR

SEPA Outgoing: 5 EUR

SEPA Incoming: 3 EUR

SWIFT Outgoing: 0.1%, min 50 EUR

SWIFT Incoming: 15 EUR

Compliance Intensive:

Initial Fee: 500 EUR

Monthly Fee: 200 EUR

SEPA Outgoing: 0.2%, min 5 EUR

SEPA Incoming: 0.1%, min 5 EUR

SWIFT Outgoing: 0.2%, min 50 EUR

SWIFT Incoming: 0.1%, min 30 EUR

Personal Accounts, Pricing

EEA Residents:

Initial Fee: Free

Monthly Fee: 5 EUR

SEPA Outgoing: 1 EUR

SEPA Incoming: Free

SWIFT Outgoing: 30 EUR

SWIFT Incoming: 5 EUR

Non-EEA Residents:

Initial Fee: 50 EUR

Monthly Fee: 30 EUR

SEPA Outgoing: 5 EUR

SEPA Incoming: 2 EUR

SWIFT Outgoing: 0.1%, min 50 EUR

SWIFT Incoming: 10 EUR

Summary

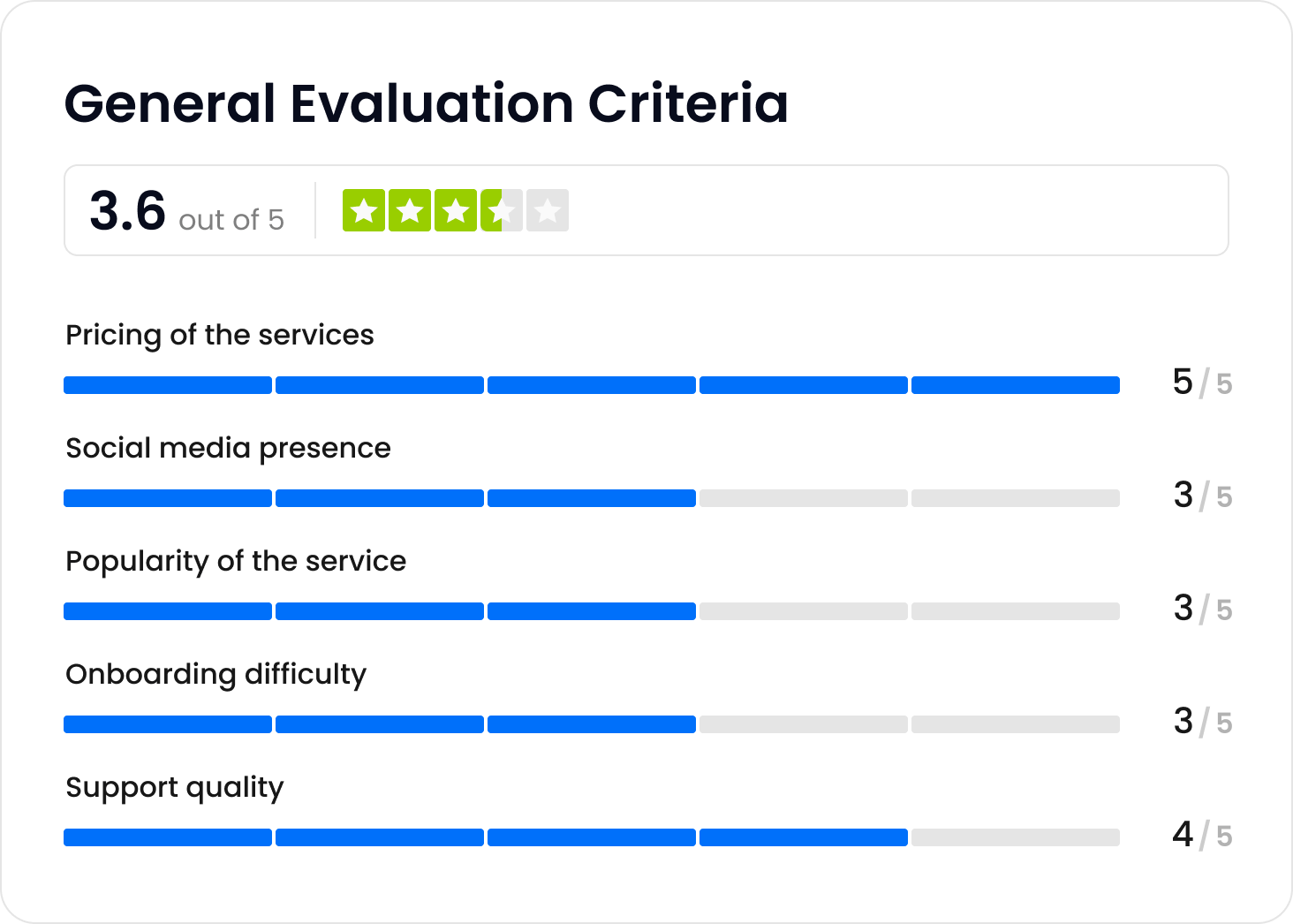

To assign a rating score, Finscanner assesses such key criteria as the pricing of the services, onboarding difficulty, support quality (customer service), and service popularity. In summary, IBS was assigned the overall rating of 3.6 (Great) which is explained in detail below.

Expert Review of IBS

“IBS is a company with a solid reputation, no bad records, and strict compliance with KYC/AML. By general reckoning, it is well placed to effectively reduce the cost of trade settlement between China and Europe and help improve the financial infrastructure of countries along the “Belt and Road” in the future.

At the moment, the company continues to expand its business presence in Europe. It is also expected that IBS will soon release remittance services and payment cards for businesses and individuals.”

Are you ready to start using IBS?

All you need to do is to go to the Finscanner marketplace, search for the IBS profile, and hit the "Apply" button. Next, you need to set up your business or personal account by registering a new profile and filling out an online application form.

If you still have any questions left, feel free to contact us directly today!

Read also

Reviews

Review of Nexpay — Next generation financial infrastructure for the digital business world

Finscanner will review this fintech startup that focuses on providing...

Reviews

Review of KoalaPays — Flexible payment solutions

Our KoalaPays analysis covers everything you need to know about their open solutions and services, containing the latest information.