What is a Bitcoin ETF?

Since its launch in 2009, Bitcoin has remained the flagship cryptocurrency, outperforming altcoins in value and capitalization. In 2021, large companies began investing in cryptocurrency, such as Tesla, MicroStrategy, The Motley Fool, and others. Gradually, Bitcoin is turning into a legal investment asset, finding more and more recognition. However, some institutional investors and individuals need a legal framework to be able to invest. And many believe that Bitcoin ETF can solve this problem.

What is ETF?

ETF is an Exchange-Traded Fund that buys securities of various companies and collects them in an investment portfolio, then selling shares to investors. It represents a type of security that acts as a certificate for a portfolio of stocks, bonds, commodities, or cryptocurrencies. The price of this security follows the index based on certain underlying assets. ETF shares are traded on the stock exchange like regular securities and often have lower fees than other types of funds.

In the United States, an ETF provider applies to the Securities and Exchange Commission (SEC) to register a fund. The latter classifies the shares of such funds as securities.

For investors, ETF is an opportunity to invest in a whole basket of assets at once. For example, you can buy shares in the S&P 500 ETF, thereby investing in the 500 largest companies in America.

Bitcoin ETF

A Bitcoin ETF follows the same principle. The fund buys cryptocurrency and sells its shares to investors on the stock exchange. In this way, investors make money on crypto without buying it directly from specialized cryptocurrency platforms. It helps to cut out any issues of complex storage and security procedures required of cryptocurrency investors. In addition, investors are not exposed to the risks of hacking trading platforms, fraud by dishonest exchange owners, or phishing attacks. The depository monitors the work and transparency of the fund, the fund reports to the regulator (SEC).

Learn how to store your crypto assets safely [here](https://finscanner.medium.com/how-to-store-your-crypto-assets-different-types-of-wallets-c878e61d64a4).

As a result, a Bitcoin ETF combines the best parts of two popular investments: the ease and security of investing in ETFs and access to the popular cryptocurrency Bitcoin.

So, to summarize, Bitcoin ETF has several advantages, namely:

- No need to go into the details of storing crypto safely yourself;

- An online broker is significantly more secure, faster, and less prone to outages than * * * purchasing directly from a crypto exchange;

- Clear tax implications and guidance for traditional financial products.

However, it does not seem logical for some people and crypto-enthusiasts to invest in a Bitcoin ETF, and here is why:

- Crypto markets run 24/7, while ETFs can only be bought and sold during market trading times;

- Bitcoin is free to hold on your own, but ETFs charge management fees;

- ETFs require you to trust third-party custodians, which is contrary to the very essence of the anonymous concept of Bitcoin.

Should I invest in Bitcoin ETF?

Based on the above, it is up to you to decide if a Bitcoin ETF is the right financial instrument for investing in Bitcoin. There are several benefits to investing in Bitcoin ETFs. And if they appeal to you, then ETFs are a good choice. Of course, everyone has their own approach to investment, risk tolerance, and ideology of digital assets. For example, Bitcoin evangelist Andreas M. Antonopoulos considers such fund as a “terrible idea.” According to his review, ETFs will make the cryptocurrency market more centralized and prone to aggressive manipulation by institutional investors.

On the other hand, a Bitcoin ETF allows investors in traditional markets to access Bitcoin in a regulated space. It can also be a good way to spread cryptocurrencies as assets more widely in terms of “investment” among institutional investors. All these can eventually accelerate the process of cards/payment solutions for Bitcoin, making it a handy medium of exchange.

Other ways to invest in cryptocurrency

You can always invest directly in cryptocurrency, as most of the users do. There are many types of cryptocurrencies to choose from apart from Bitcoin, like Ethereum and Tether (stablecoin).

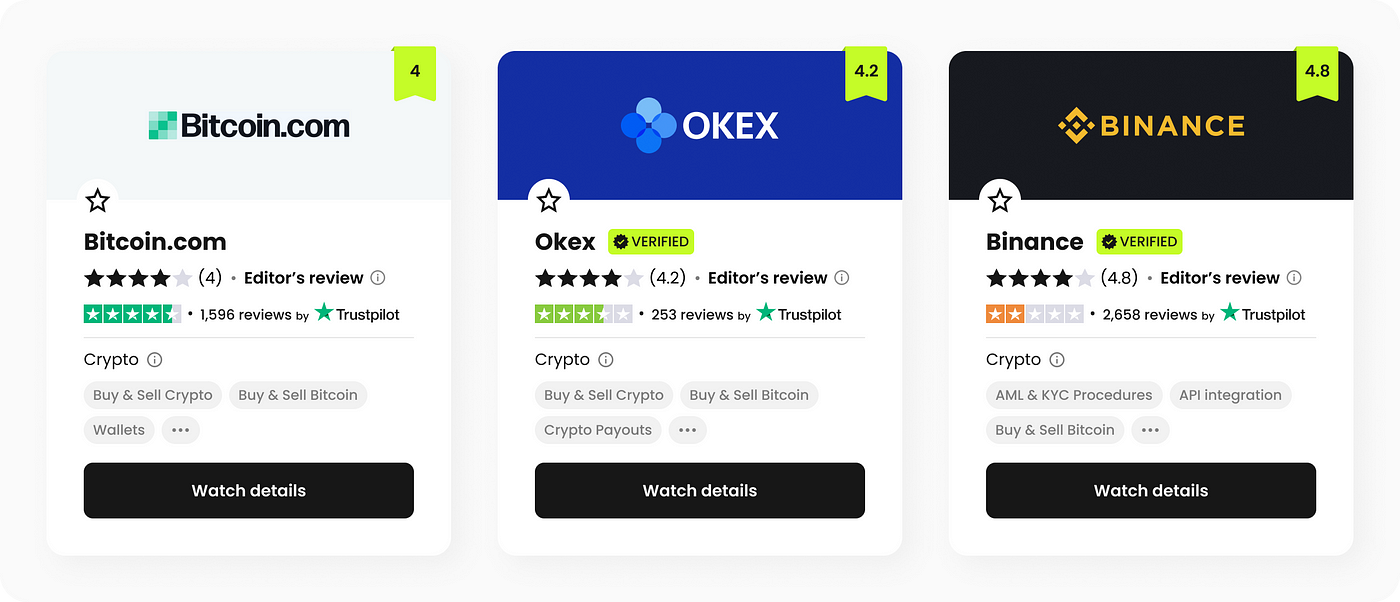

Ready to invest? Here are Finscanner’s picks for the excellent Bitcoin and crypto exchange:

- FMFW.io (Bitcoin.com Exchange) — an exchange registered in Saint Kitts and Nevis. Here one can trade more than 200 digital assets. As main advantages, the platform highlights that it is secure, fast and that they have dedicated 24/7 support.

- OKEx — a cryptocurrency exchange created in 2014 by Chinese developer Star Xu. It makes it easy to buy, sell, or trade cryptocurrencies by offering over 400 trading pairs, including pairs with fiat. OKEx offers advanced financial services as well as excellent guides for anyone new to crypto. There are investment programs, a referral program, and additional bonuses.

- Binance — a crypto exchange founded in 2017 by Changpeng Zhao and registered in the Cayman Islands. It is the largest cryptocurrency exchange in the world in terms of trading volume, with more than 1.4 million transactions per second. The exchange strictly adheres to US regulations, is compatible with multiple devices, and provides safe and convenient trading.

Find more crypto products at the Finscanner marketplace to buy your first crypto, connect cryptocurrency payment gateways, send, receive or exchange your assets, and explore other functions as well!

Read also

Crypto

Trends of 2022 — NFT, Metaverse and GameFi

The digital currency industry has experienced accelerated growth in 2021, with many new trends emerging.

Crypto

Best Crypto Payment Gateways to Connect to in 2022

If you'd like to implement innovation in your startup or business, you better be looking for transaction...