Review of Valyuz — Rising above banking experience

Looking for alternative solutions to traditional banking? It is worth paying attention to Valyuz electronic money institution!

Finscanner will review this great payment service provider that offers alternative solutions to regular banking and payment accounts for individuals and companies world-wide. Our Valyuz analysis covers everything you need to know about their open solutions and services, containing the latest information.

Learn more about EMIs in our article «Banking with Electronic Money Institutions».

Valyuz is an authorized electronic money institution based in Vilnius, Lithuania in 2018. It offers SEPA transfers, SWIFT transfers, personal and business virtual accounts with IBAN, competitive fees for currency exchange, debit cards, web and mobile app.

Not so long ago, Valyuz was being under sanctions imposed by regulators. Primarily it was due to the way that the funds were stored in electronic money and payment institutions, although under the Law on Electronic Money and Electronic Money Institutions, these funds must be kept in credit institutions, central banks or invested in safe liquid funds in Lithuania or other European Union countries. However, Valyuz has already corrected the violations.

According to Finscanner, the Valyuz was placed in Top-10 best e-Money Institutions for high-risk businesses in 2022. Learn more here.

✅ Pros

- Flexible fees

- Debit cards

- Multiple currencies

- Personal accounts

❌ Cons

- Offshore entities only partially accepted

- No C2B accounts

- No dedicated SWIFT IBAN

NOTE: The above-mentioned pros and cons are drawn up by the Finscanner team’s point of view, while other Valyuz reviews may say otherwise.

Profile

Valyuz UAB is an electronic payment company No. 304782929 authorized by the Bank of Lithuania (LB000454) under the Law on Electronic Money and Electronic Money Institutions 2011 for the Issuance of electronic money.

Currency: 35 currencies

Business focus: providing alternatives to traditional banking.

Products: debit cards, personal & business virtual accounts with IBAN, app.

Customer groups: all countries.

Authorized activities: issuance of electronic money, withdrawing cash from a payment account, execution of payment transactions on a payment account (not covered by a credit line), issuing payment instruments, or acquiring payment transactions.

Operations with cryptocurrencies: No

Personal Accounts, Pricing

Initial Fee: 50 EUR

Monthly Fee: 10 EUR

SEPA Outgoing: 5.00 EUR

SEPA Incoming: 5.00 EUR

SWIFT Outgoing: 0.3% min 25 EUR

SWIFT Incoming: 0.25% min 20 EUR, max 120 EUR

Business Accounts, Pricing

Low-risk, Category 1 (Basic / Advanced / Premium):

Initial Fee: 500 EUR / 250 EUR / Free

Monthly Fee: 25 EUR / 250 EUR / 500 EUR

SEPA Outgoing: 10 EUR / Free / Free

SEPA Incoming: 10 EUR / Free / Free

SWIFT Outgoing: 0.25% min 25 EUR / 0.20% min 25 EUR / 0.15%

SWIFT Incoming: 0.25% min 25 EUR / 0.20% min 25 EUR / 25 EUR

Related to high risk, Category 2 (Basic / Advanced / Premium):

Initial Fee: 900 EUR / 450 EUR / Free

Monthly Fee: 150 EUR / 1000 EUR / 1500 EUR

SEPA Outgoing: 10 EUR / Free / Free

SEPA Incoming: 0.25% min 10 EUR / Free / Free

SWIFT Outgoing: 0.5% min 50 EUR / 0.35% min 50 EUR / 0.25%

SWIFT Incoming: 1.00% min 50 EUR / 0.75% min 50 EUR / 0.5%

High risk, Category 3 (Basic / Advanced / Premium):

Initial Fee: 2000 EUR / 1000 EUR / Free

Monthly Fee: 500 EUR / 4000 EUR / 6000 EUR

SEPA Outgoing: 0.4% min 25 EUR / Free / Free

SEPA Incoming: 0.4% min 25 EUR / Free / Free

SWIFT Outgoing: 1.00% min 50 EUR / 0.75% min 50 EUR / 0.5%

SWIFT Incoming: 1.5% min 50 EUR / 1.00% min 50 EUR / 0.5%

Debit Cards, Pricing

Valyuz offers MasterCard debit card. It is available to all corporate clients no matter where their business is incorporated. Once applied, the debit card will be sent via post directly to the address provided on the questionnaire. It usually takes around 5-7 business days for the card to arrive.

(Basic / Advanced / Premium):

Card order: 100 EUR / 50 EUR / Free

Monthly card fee: 15 EUR / 7.5 EUR / Free

Card upload: 15 EUR / 7.5 EUR / Free

Summary

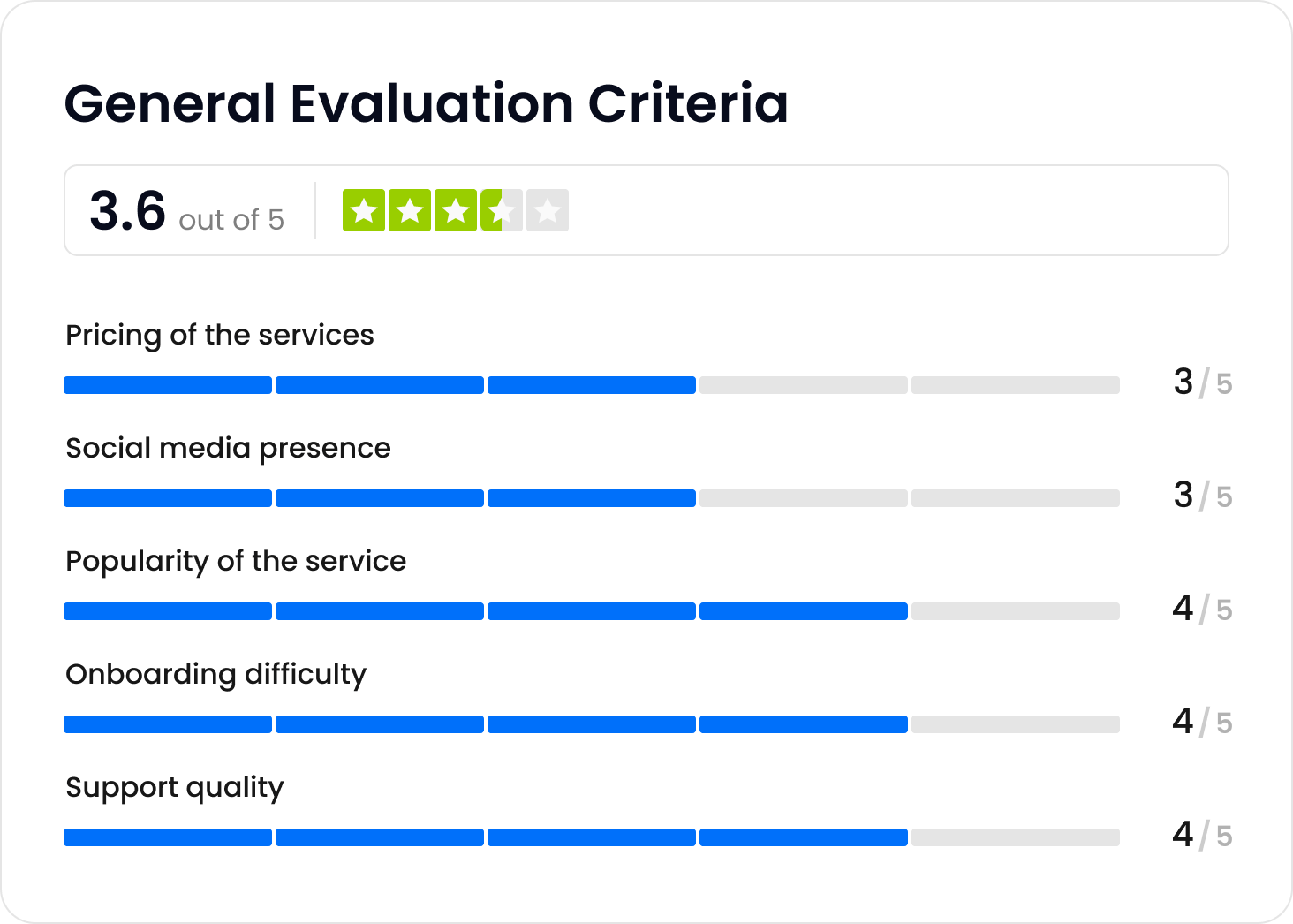

To assign a rating score, Finscanner assesses such key criteria as the pricing of the services, onboarding difficulty, support quality (customer service), and service popularity. In summary, Valyuz was assigned the overall rating of 3.6 (Great) which is explained in detail below.

Expert Review of Valyuz

“Valyuz is well versed in different business models and companies with international shareholders and covers many industries. As we have already stated, it might be a great option for high-risk businesses.

Speaking of prospects, this e-money institution has room to develop and improve its services. However, there is a high level of competition in the market right now, and it is quite difficult to be a bright spot against other EMIs.“

Are you ready to start using Valyuz?

All you need to do is to go to the Finscanner marketplace, search for the Valyuz profile, and hit the "Apply" button. Next, you need to set up your account and fill out an online application form. After the submission, the Valyuz team will review it and guide you through the process, and will assist you with the required information/documentation. At the time of writing, only Valyuz business accounts can be opened.

If you still have any questions left, feel free to contact us directly today!

Read also

Reviews

Review of Nexpay — Next generation financial infrastructure for the digital business world

Finscanner will review this fintech startup that focuses on providing...

Reviews

Review of IBS — Financial link between Europe and China

Looking for an innovative channel for funds transfer? It is worth paying attention to IBS electronic money institution!