Review of KoalaPays — Flexible payment solutions

Looking for a flexible payment solution for your business? It is worth paying attention to KoalaPays electronic money institution!

Finscanner will review this relatively new all-in-one platform that focuses on local and international money transfers. Our KoalaPays analysis covers everything you need to know about their open solutions and services, containing the latest information.

Learn more about EMIs in our article «Banking with Electronic Money Institutions».

KoalaPays is an authorized electronic money institution based in Brno, Czech Republic in 2020. It offers multi-currency accounts, cross-border payments, dedicated bank accounts, and exchange services with advanced trading tools.

The platform has gained the recognition and trust of many global companies and financial corporations, but mostly it has become a real trend across online casinos.

In 2021 KoalaPays acted as a sponsor to iFX EXPO in Dubai, the largest global fintech b2b exhibition.

KoalaPays is placed in the Top-10 best e-Money Institutions for high-risk businesses in 2022. Learn more here.

✅ Pros

- Crypto-friendly accounts

- SEPA/SWIFT IBANs

- Debit cards

- Paypal functionality

- API integration

❌ Cons

- No C2B accounts

- Long onboarding procedure

- High transaction fees

NOTE: The above-mentioned pros and cons are drawn up by the Finscanner team’s point of view, while other KoalaPays reviews may say otherwise.

Profile

Safe Payments Solutions s.r.o trading as KoalaPays is an electronic money institution incorporated in Czech Republic under registration number 06419526, the registered office of which is Kamenickova 1114/2, 616 00 Brno-Zabovresky. Company is regulated by the Czech National Bank as an electronic money issuer.

Currency: 20+ currencies

Business focus: local and international money transfers.

Products: business IBAN accounts, physical and virtual cards, trading tools, e-wallet, app.

Customer groups: EU, offshore, high-risk.

Authorized activities: issuance of electronic money, execution of payment transactions on a payment account (not covered by a credit line), issuing payment instruments or acquiring payment transactions, money remittance.

Crypto-Related Activities: Yes

Business Accounts, Pricing

Licensed EU, Category 1:

Initial Fee: Free

Monthly Fee: 29 EUR

SEPA Outgoing: 40 EUR (standard), + 1% (express)

SEPA Incoming: 0.7% +10 EUR

SWIFT Outgoing: 40 EUR (standard), + 1% (express)

SWIFT Incoming: 1.0% +10 EUR

EU, Category 2:

Initial Fee: Free

Monthly Fee: 49 EUR

SEPA Outgoing: 40 EUR (standard), + 1% (express)

SEPA Incoming: 1.0% +10 EUR

SWIFT Outgoing: 40 EUR (standard), + 1% (express)

SWIFT Incoming: 1.5% +10 EUR

Offshore, Category 3:

Initial Fee: 250 EUR

Monthly Fee: 150 EUR

SEPA Outgoing: 40 EUR (standard), + 1% (express)

SEPA Incoming: 1.5% +10 EUR

SWIFT Outgoing: 40 EUR (standard), + 1% (express)

SWIFT Incoming: 2.0% +10 EUR

Gambling, Category 4:

Initial Fee: 250 EUR

Monthly Fee: 150 EUR

SEPA Outgoing: 40 EUR, +1% (express)

SEPA Incoming: 1.5% + 10 EUR

SWIFT Outgoing: NOT available

SWIFT Incoming: NOT available

Debit Cards, Pricing

Koalapays offers Mastercard, Visa/VISA Electron, Maestro debit cards for EEA entities. The card is linked to the KoalaPays account and can be instantly topped up from the account and used for day-to-day expenses, online purchases, or withdrawal cash at the ATM.

Card order: 14.99 EUR (physical) / 4.99 EUR (virtual)

Monthly card fee: 2 EUR

Account to card transfer: 1% (min 2 EUR)

Card to account transfer: 0.5% + 1 EUR

ATM withdrawal: 1.5% + 4.5 EUR

Summary

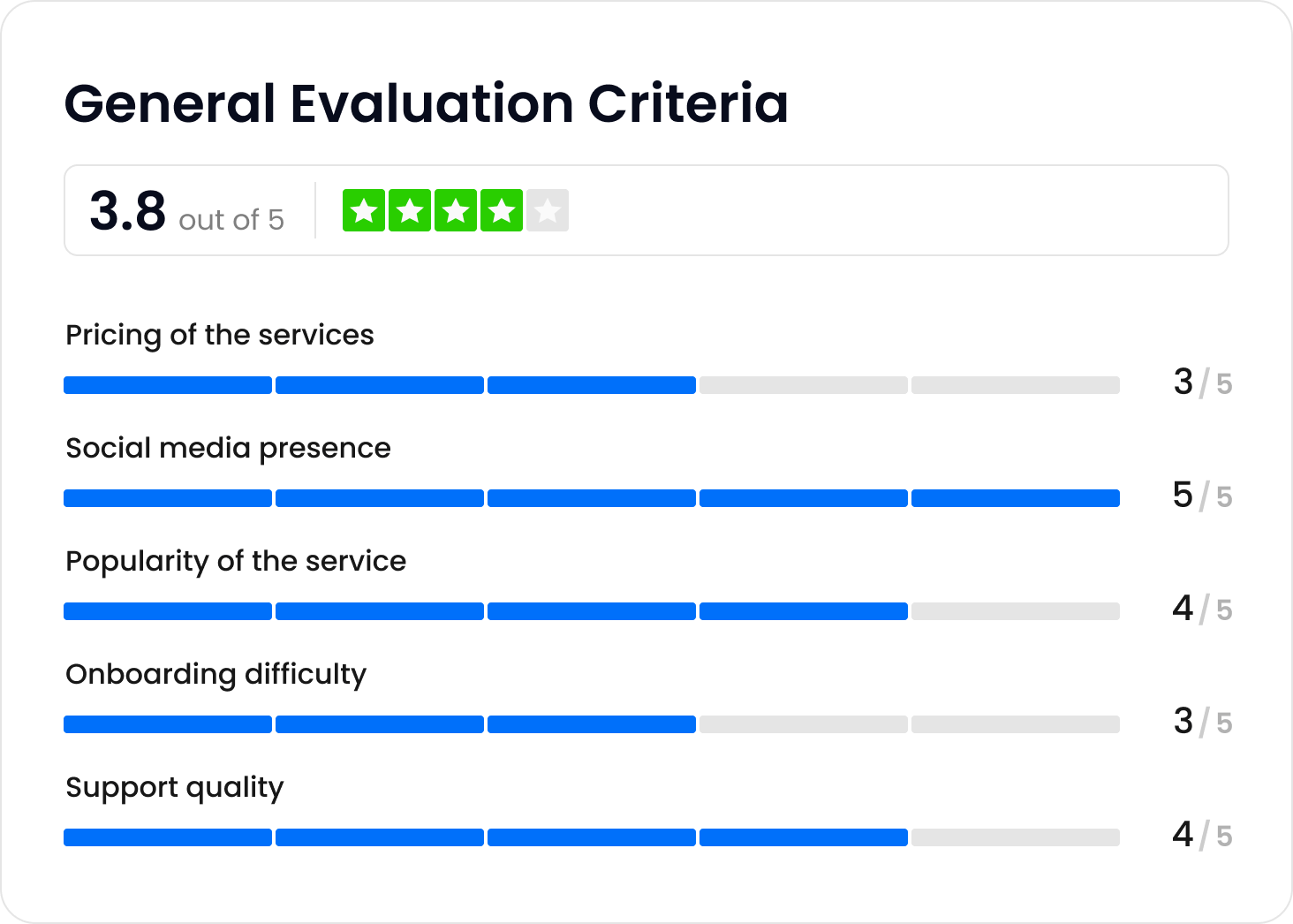

To assign a rating score, Finscanner assesses such key criteria as the pricing of the services, onboarding difficulty, support quality (customer service), and service popularity. In summary, KoalaPays was assigned the overall rating of 3.8 (Great) which is explained in detail below.

Expert Review of KoalaPays

“KoalaPays is a platform that we value primarily for dealing with high-risk businesses. In this category, they have very competitive transaction fees. Needless to say, many online casino users are already enjoying many perks and benefits of KoalaPays. However, I see many other industries where this platform can prove itself in the future.“

Are you ready to start using KoalaPays?

All you need to do is to go to the Finscanner marketplace, search for the KoalaPays profile, and hit the "Apply" button. Next, you need to set up your business account and fill out an online application form.

If you still have any questions left, feel free to contact us directly today!

Read also

Reviews

Review of Nexpay — Next generation financial infrastructure for the digital business world

Finscanner will review this fintech startup that focuses on providing...

Reviews

Review of IBS — Financial link between Europe and China

Looking for an innovative channel for funds transfer? It is worth paying attention to IBS electronic money institution!