Neobanks: Everything You Need to Know

Neobank is a new FinTech trend in the world, the popularity of which has increased due to the COVID-19 pandemic. In order to ensure safety, people began to look for opportunities to remotely buy stuff, pay for services, etc. This led to the growing popularity of neobanks — financial institutions that provide services exclusively online. These “challenger banks” do not use branches to serve customers, instead, they are available exclusively through digital devices.

Neobanks are changing the face of fintech and could one day eclipse traditional banks. Let’s understand what happens and what it means.

What is Neobank?

Most traditional banks are bogged down in their outdated infrastructure. As such, they exhibit low adaptability and imperfection when it comes to aiding SMEs with financial services such as providing a payment gateway, billing software, multiple money management, etc.

As customer financial needs shift towards automation and digital accessibility, a gap has formed between what traditional banks offer and what customers actually expect. This is where neobanks come in handy, trying to fulfill the gap.

You can think of neobanking as a cheaper, multi-functional alternative to traditional banks. It is a wide range of financial service providers that are highly regarded by today’s tech-savvy clients. Neobanks can be called fintech firms that provide digital and mobile finance solutions, payments and money transfers, lending, and more. They focus on modern technologies that allow processing large amounts of data and providing services to the general public due to their availability. There are two types of neobanks:

- Licensed, providing financial services on their own;

- Non-licensed, cooperating in partnership with a traditional bank.

How it works

Neobanks provide customers with personalized services and significantly low fees since they have no physical location and are fully connected to the Internet. Their platforms and infrastructures are also heavily modernized, making it easier for them to collect and analyze data and understand how their customers behave in the neobanking ecosystem. Here are technological advancements that allow these fintechs to challenge the traditional banking system:

- Open Banking API (mandatory within the UK) — an integration of financial institutions and third-party providers to access clients’ data and enhance the development of various software solutions.

- Mobile App — a neobank is an app-based bank in its nature. Learn more about mobile banking here.

- **Cloud adoption — a strategy used to improve the scalability of Internet-based database capabilities while reducing cost and risk.

- AI & ML — advanced technologies uncovering a large segment to streamline processes and data to make better business decisions.

- Blockchain — a leading innovation to reduce fraud, ensure quick and secure transactions and trades, and help manage risk within the interconnected global financial system.

The benefits of Neobanking

Let’s summarize some of the main benefits of using a neobank:

- Minimum overheads. With neobanking, the mobile application or the desktop interface is the only real estate to be maintained. As a result, Neobanks deliver financial services at a much lower cost.

- Technology-driven. As we have already mentioned, neobank fintech startups are acing the implementation of technology into their business models, offering services above and beyond what traditional banks can offer.

- Competitive interest rates. One of the highly demanded fintech trends is higher interest rates that also apply to many neobanks.

- Ease of use. The impact of technology on banking processes has led to the fact that neobanks have equipped their platforms with convenient capabilities for effectively solving customer problems in real-time.

- Economy driver. The total number of neobanks is growing year after year. According to Zion Market Research, the sector is predicted to grow at a CAGR of 5% between 2019 and 2026, generating about $ 394 billion by 2026.

Neobank landscape

The banking sector’s digital transformation is faring well with more neobanks on the horizon. One can find many reasons for switching to neobank as a smart financial move. If you’re thinking of setting up an account and would like to find more details, the Finscanner Marketplace is a great place to find the right account for your needs.

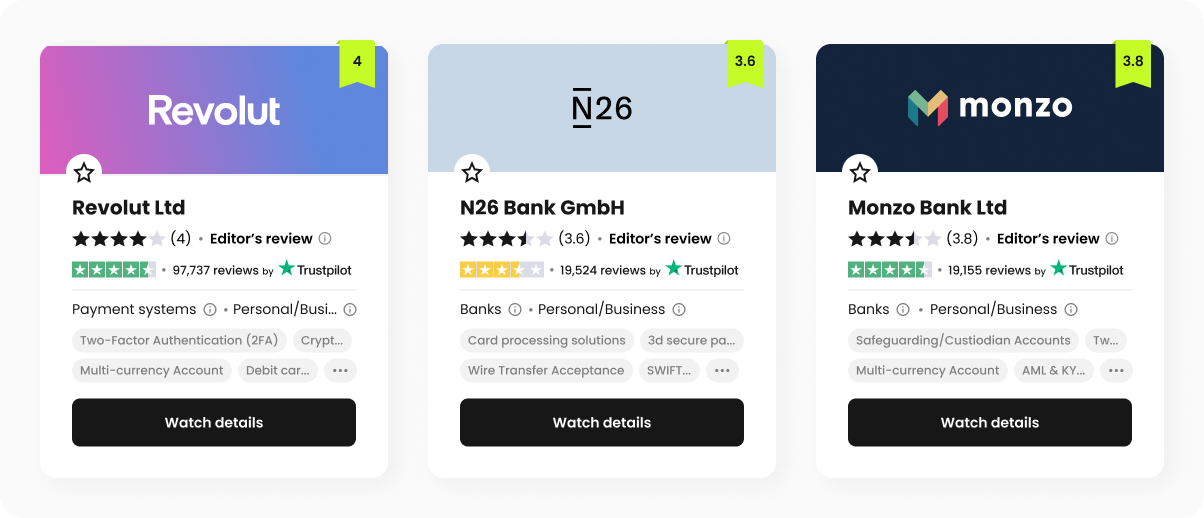

Here are some of the neobanks you can explore:

- Revolut Ltd — a UK fintech company founded in 2014 specializing in financial technology that offers banking services including accounts with IBAN, prepaid MasterCard or VISA debit card, commission-free currency exchange, stock trading, cryptocurrency exchange, and peer-to-peer payments.

- N26 Bank — a mobile bank founded in Berlin in 2013. It serves across 23 countries and offers retail banking products and services online. N26 has four account types: Standard, You, Metal, and Business.

- Monzo Bank — a digital bank founded in London in 2015. It operates via smartphones and offers current and business current accounts, joint accounts, payment cards, savings accounts, overdrafts, and consumer loans.

Find more neobanks at the Finscanner Marketplace to open your first account and explore all the benefits of the modern financial world!

Read also

Finance

The Future of Money – Will Physical Money Disappear?

Over the past few years, much attention has been paid to the future of money.

Finance

Mobile Banking for Abroad Students in Europe

Studying in Europe is becoming more popular and relevant, due to the high quality of education and the prospect of building a brilliant international career.