Benefits of International Bank Accounts

The vast majority of individuals and small businesses around the world often have only national bank accounts. Sometimes that’s all it takes, but for those who are serious about international investment and the ability to access safer banks in stable banking jurisdictions, relying solely on national bank accounts won’t be the right choice. Instead, it makes sense to open an international bank account.

In order to dive into the details and learn about the specific benefits that are attracting so many people to international banking, this article is right for you!

Getting ahead of the story, we would like to mention the following top benefits:

- Competitive Currency Exchange Rates

- Broader Access to Investment Opportunities

- Asset Protection from Issues at Home

- Minimizing the Tax Obligation

- Higher Interest Rates

- Lower Fees for International Businesses

Further, we’ll take a closer look at all of the above opportunities.

Competitive Currency Exchange Rates of International Banks

You can slightly expand your resources and capabilities by making the most of the foreign exchange market. In this case, you have the opportunity to determine which exchange rate is more favorable for you today. After all, whether you need Euros or Singapore Dollars, multiple expensive currency conversions can be a waste of time and money. A much better option is to always have some of your preferred foreign currencies in liquid form through the use of an international bank account.

In scenarios where you need to convert a national currency into either currency and then exchange it for another one that yields more returns, avoiding fluctuating exchange rates, establishing an international bank account is the right option. Thus, you have that much more financial security.

Broader Access to Investment Opportunities

On the subject of investments, it is fairly obvious that there are certain limitations. Attempting to purchase shares of stock, bond issues, or participate in other investments activities may not be possible in your home country. Moreover, the returns on those investments could be quite high in comparison to similar national investments. You don’t want to miss this opportunity for sure! Luckily, with an international bank account, you can skip ahead with these misunderstandings and get in on those investments.

Asset Protection from Issues at Home

Asset protection remains a major benefit of an international bank account. When you keep all of your assets in the same country you live in, you’re exposed to serious legal and financial risks. In other words, you need that diversification. In this case, you can simply have bank accounts in different countries that are subject to different laws, thereby minimizing risks and legally protecting yourself from a host of hardships.

Minimizing the Tax Obligation

Another benefit that serves as a major attraction to offshore banking, is lower taxes or no taxes at all. It has also a good way for effective tax and inheritance planning, making many people’s lives easier.

The facilities that apply in each particular case will depend on personal circumstances, such as a country of residence. When a person opens an international bank account, his assets may be assessed for taxation according to local laws. In many offshore countries, tax codes are quite favorable for foreign investors.

Higher Interest Rates

It is far from easy to deal with a situation where inflation exceeds the interest rates of your national bank. Thankfully, if you go abroad, the situation can change in a favorable direction. International savings accounts can offer competitive interest rates of up to 6% in US dollars.

But remember, economic situations in other countries are always different, and solely relying on the interest rate number is not an option. The highest possible return with minimal risks considers fixed deposits in relatively stable currencies, such as the US dollar and Euro.

Lower Fees for International Businesses

Cross-border transactions and deals with other currencies are a daily scenario for international businesses. And offshore banking helps these businesses more than ever to keep costs low by operating in desired currencies, reducing foreign exchange fees, transfer fees, and multigate foreign exchange fluctuations.

Next Steps

As you can see, there are lots of benefits of opening an international bank account these days. We have mentioned just the key ones.

There are much more reasons for opening an international bank account as a smart financial move. If you’re thinking of setting up offshore accounts as you plan to progress towards your stated goals and would like to find more bank profile details, Finscanner.io is here to oblige and set up the right account for your needs.

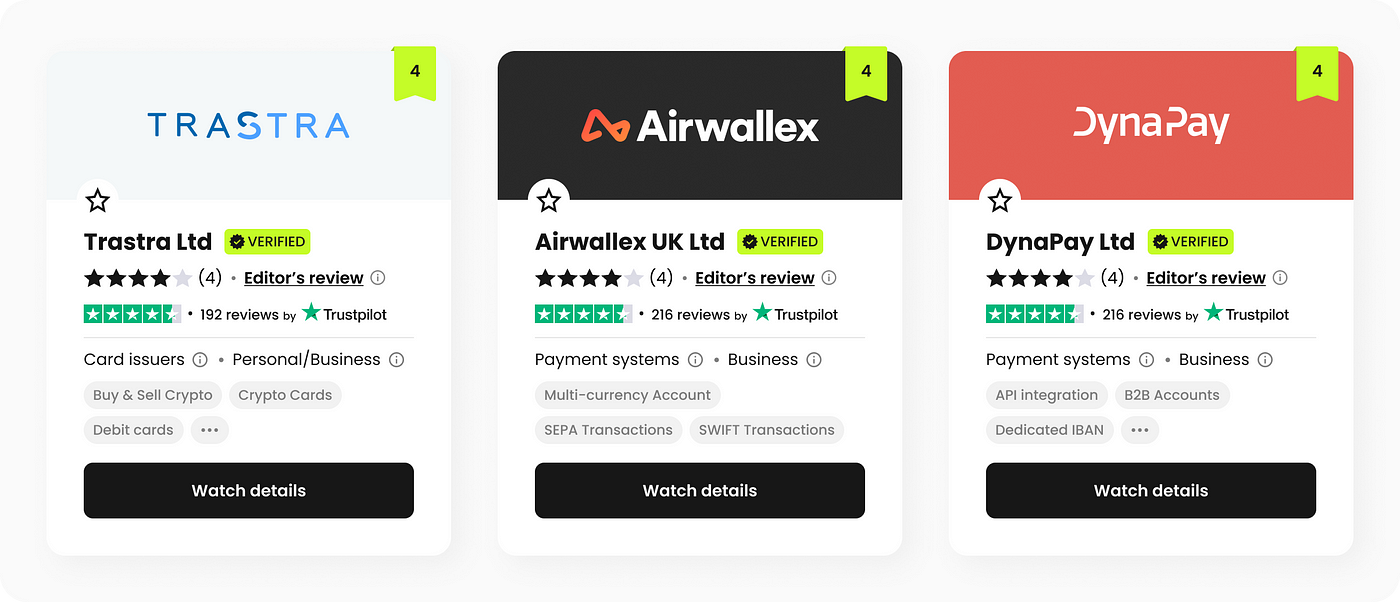

Here are some of the international banks you may find at our marketplace:

Trastra Ltd — a company duly incorporated in England and Wales. The Trastra Debit card, issued by VISA, is an ideal solution for converting Cryptocurrencies to euros and cashing out without using a bank account. Trastra’s solution combines: BTC, ETH, LTC, BCH, XRP, USDC and USDT wallets; An integrated IBAN to receive euros; Instant crypto-euro exchanging; The lowest possible commissions when purchasing crypto through IBAN transfers; The use of a Visa debit card; A Web/Mobile application.

DynaPay Ltd — an electronic money institution focused on providing banking alternative for online-oriented businesses for low and medium-risk merchants. DynaPay is a part of DYNINNO Group that provides in-house IT solutions, lead generation and sales to brands operating in more than 50 markets worldwide. DynaPay Ltd offers virtual IBANs for payments in GBP, USD, EUR and 30+ world’s currencies and currency exchange at wholesale rates. In 2019 DynaPay Ltd had total assets of 348,244.00 GBP, DynaPay Ltd generated a net income of -268,019.00 GBP. Incorporated in the United Kingdom, DynaPay Ltd is authorized and regulated by the Financial Conduct Authority.

Airwallex UK Ltd — is an electronic money institution focused on high-speed, low-cost global payments. Airwallex UK Ltd offers foreign exchange, international payments, global accounts, payment cards, card acceptance to business entities. In 2019 Airwallex UK Ltd had total assets of 2.25 mln GBP, Airwallex UK Ltd generated a net income of -1,512,991.00 GBP. Incorporated in the United Kingdom, Airwallex UK Ltd is authorized and regulated by the Financial Conduct Authority.

Find more international banks at the Finscanner marketplace to open your first account and explore all the benefits of the financial world!

Read also

The Future of Money – Will Physical Money Disappear?

Over the past few years, much attention has been paid to the future of money.

Mobile Banking for Abroad Students in Europe

Studying in Europe is becoming more popular and relevant, due to the high quality of education and the prospect of building a brilliant international career.